PayPal have quietly launched the ability to buy and hold crypto currencies. Currently [December 2022] Bitcoin, Ethereum, Litecoin and Bitcoin Cash are available to buy and sell for UK PayPal account holders.

The buying process is simple, possibly too simple. In the USA there is a tax related question before signing up but this is bypassed in the UK, funds come straight out of the PayPal balance or from a linked debit card and bank account. PayPal do throw up warnings on the volatility of cryptocurrency and the lack of regulation of the medium but ‘in short’ a few clicks and you are in.

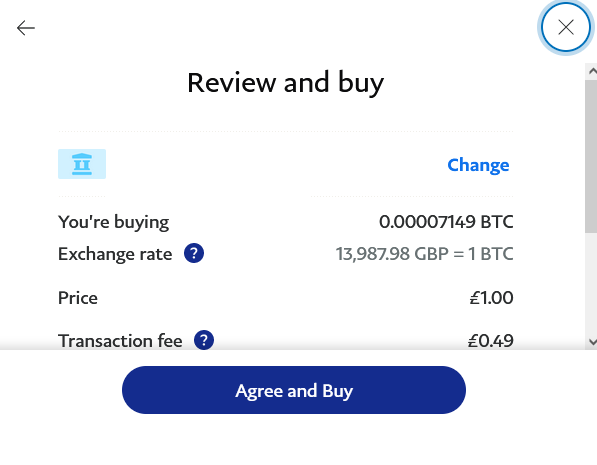

A PayPal account holder can select the cryptocurrency and buy in for as little as £1. Buying and selling fees are fixed for purchases up to £200 and then are a % of the purchase. Unlike Gas fees these will not fluctuate constantly although PayPal could update their fee structure at any time. As the purchase is made in USD the investment in £s will be converted to $s then used to buy cryptocurrency. This could lead to additional fees from the bank account used to fund the transaction. Looking at the current situation it would be best to first pay cash into the PayPal balance and buy cryptocurrency at the top end of the fee bands, £74.99 or £200 for small investments. Anything less than £25 and the fees will be a substantial part of the transaction. Very small investments should really be seen as a paid lesson in how cryptocurrency currency works and how its value fluctuates rather than in any hope to make a profit out of it; £1.50 well spent.

PayPal on the other hand are making money out of their fees as well as a mark up on any currency conversion within PayPal to and from USD.

The ability to pay for goods directly with cryptocurrency has been introduced in the USA but is not being promoted in the UK. Another USA restricted feature is to transfer cryptocurrency holdings to and from selected other wallets and PayPal. Until these features become more widely available the UK PayPal customer is restricted to investing only. This would mean that to work with any funds earned through PayPal investments the holdings would need to be sold, converted from USD and moved out of the PayPal system, all subject to additional fees.

Even looking at the basic fee structure PayPal is not the cheapest way to invest in cryptocurrency it is almost certainly the easiest way to get in. The buyer does not receive the private keys to their holding nor does PayPal support the concept of a personal wallet. Secure access to cryptocurrency funds and how much of that is stored off-line is the responsibility of PayPal not the currency’s owner. This is a common business model of cryptocurrency currency exchanges and is not necessarily a bad thing. Security rests with the exchange and not the individual.

PayPal is a security topic all on its own. It is well established with the funds to back up possible losses but is also a haunt of scammers and con artists. PayPal are prepared for fraud to a degree that few start ups could compare to but the scammers will keep trying to find a way round it. A common approach is some sort of scam to reveal the name and password to access an account. This is probably why PayPal sends so few messages to its members about the general running of accounts; they are too easy to spoof. PayPal messages generally relate to specific and recognisable transactions.

With complete control of an account the criminal can empty any existing balance plus siphon more money into PayPal funds from a linked bank and send it back out to themselves. Selling off any cryptocurrency holdings on PayPal and taking the proceeds would not be a problem. PayPal provide guides on how to identify and report fraud but the onus is always on the receiver of suspect emails, texts or phone calls to recognise them for what they are. Many PayPal users only keep modest amounts of cash within their PayPal balance; large sums being withdrawn to conventional banks where there are additional safeguards in place. A larger cryptocurrency investment will need to stay on PayPal’s system to hopefully benefit from the market so a holder needs to be especially aware of attempts to scam their PayPal account. This is not to imply that PayPal is any less robust than any other crypto exchange. The trader needs to weigh the risk of using less well established platforms against a higher fee structure.