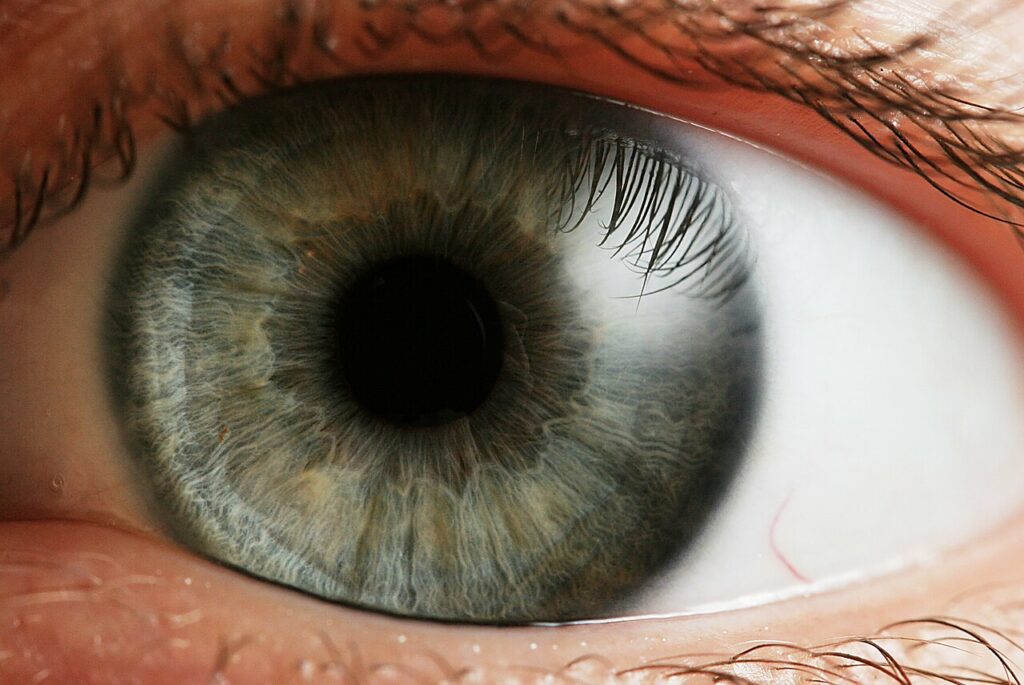

WorldCoin (WLD) has launched across multiple countries with the promise of free crypto in exchange for your retina scan. In the UK scans are currently only on offer at 2 locations both in London and with an on-line booking system for a 30 minute appointment. In Kenya the offer was suspended because of the crowds of applicants showing up for their free coin and their government’s concern about privacy. An applicant will need the retina scan together with the WorldCoin app which will generate an anonymous but unique person code. This will then be linked to the retina scan. In theory no personal identification is needed although at some point users will want to cash in or even add to their WorldCoin and that will lead to wallet details and a real bank account.

The first issue to note is that WorldCoin is not WorldCoin. The latter is a live cryptocurrency trading as WDC, they have this to say about the matter:

‘We are not the “ORB RETINA SCANNING WORLDCOIN”. They are imposters stealing our name just like WISDOM CHAIN stole our ticker. So be sure you are investing and supporting the correct Worldcoin. We are the original WORLDCOIN our ticker is WDC.’

WDC is currently (August 2023) trading at $0.01 on crypto.com. WLD is at $1.79 (August 14th 2023) with a high of $2.83 on launch on 24th July.

The attraction is largely that of free money, at present 25 WLD, about $44.75, there are also tales of a free t-shirt, at least in London. These sums are in $s so there will be additional losses from transferring to any local currencies plus the trading and gas fees needed to get any money out and use it as hard cash. Although a few crypto currencies can be used as cash in a small number of markets WLD is not one of them

There is also the hype caused by one WorldCoin co-founder being Sam Altman the ChatGPT guru. For its part WorldCoin spin the project as a means to prove that a user is human and clamp down on Internet bots. The real human behind the scan would be identified through the WorldCoin app which also acts as a wallet into their coin holdings. When making a web transaction or accessing data the engine governing that would hop onto the app or some linked portal to validate that action. This would follow the same general principles as verification pop ups and linked apps used in personal banking. None of this is in place yet but if a suitably large bank of potential users with ‘proof of personhood’ can be built up then WorldCoin may have a marketable product. As a mobile application was required to create the original ID WorldCoin can prove that users are aware of digital transactions even if they never intend to use them beyond monetising their initial stake.

For the present WorldCoin is dependent on income from its investors and trading in the coin itself. Together with the costs in operating and marketing the coin there is the need to get the iris scanning orbs out and in use. In its first 16 days WorldCoin boasted 346 orbs in use and 257,853 new accounts. The orb operator details are sketchy but it seems that suitable operators will act as an agent, receiving income from scans but needing to organise a support team, location and facilities for scanning.

The business cannot succeed by giving funds away and paying its scanner operators to do it. Income could come from trading WLD but this depends on investors buying and holding the coin in the expectation it will go up in value. The ‘proof of personhood’ hook could enable the coin to become widely adopted, facilitate its use in buying other goods, encourage its use and raise the price because users ‘need’ to buy WLD rather than for example Ethereum for their regular business needs. WorldCoin could also get income through licensing its ‘proof of personhood’ to various web engines for validation purposes. Finally and pushing the boundaries of ethics it could find some legal way of selling off the ‘anonymised’ data that it has collected.

It is no surprise that the promise of free money is most attractive to those on very low incomes. This suggests a simple way for others to cash in on the system. It is interesting that there are many people in such need who still have a connected smart phone and a bank account. If this were not the case the crowd scenes in Kenya could not have occurred. It is probable that many of these customers are more interested in an immediate reward than in medium term WLD investments. One attendee at the Hong Kong scan centre brought his 62 year old mother to be scanned, purely for the money, others came across the border from Mainland China where crypto transactions are banned. Recipients could sell off their coin, taking a hit on gas fees and currency conversion and see the money fall into the hands of their bank or they could accept a modest cash-in-hand gain and transfer the funds to someone else. That someone might collect WLD from many people and build up a portfolio worth holding onto or selling and profiting the difference between cash paid out and WLD conversion. This person could even be linked to the operation initially offering scans. The plan can be pushed further by sharing phone accounts and bank details amongst many users. These will all be unique entities but the worth of the ‘proof of personhood’ plan is reduced because a proportion of the accounts will belong to people who will never use them for such a purpose. At some point such an investor will cash in; sales of relatively large sums of WLD will cause its value to drop.

All the above is pure speculation; WordCoin have almost certainly worked a degree of profiteering within their business model. It does illustrate that to get noticed a crypto currency has to do more than launch and expect people to throw money at it. There needs to be a purpose to convince uses to make it their currency of choice.